The accounting industry has always been built on trust, reputation, and long-term relationships. But in today’s digital-first world, even the best accountants need smart marketing to stand out. If you’re running an accounting practice, you’ve probably realised that traditional word-of-mouth referrals alone aren’t enough to consistently attract high-value clients. This is where marketing for accountants comes in.

Done right, digital marketing can transform your practice, generating steady leads, establishing you as an expert, and helping you secure larger, long-term clients. Whether you run a small independent firm or a mid-sized practice competing with the “big four” in your local market, there are proven strategies that work specifically for accountants.In this guide, we’ll break down 7 powerful strategies for marketing for accounting firms that will help you generate more leads, convert more prospects, and build a stronger online presence. From local SEO to Google Ads, and from social media video content to paid campaigns, these strategies are designed to land you bigger and better clients.

Strategy 1: Local SEO for Accountants

When people search for an accountant, they almost always start online — and usually with Google. More importantly, they often add a location to their search. Terms like “accountants in London”, “tax advisor near me”, or “chartered accountant Manchester” are classic examples of local search intent. This is why local SEO should be the foundation of your digital marketing strategy.

Why Local SEO Matters for Accountants

- High intent leads: Someone searching “accountants near me” is usually ready to hire.

- Competitive advantage: Many firms still neglect SEO, relying only on referrals.

- Google Maps visibility: Appearing in the “map pack” (top 3 local results) dramatically increases enquiries.

Steps to Improve Local SEO for Accountants

- Optimise Your Google Business Profile (GBP)

Claim and fully complete your Google Business Profile. Make sure your firm’s name, address, and phone number (NAP) are consistent across the web. Add photos, services (like tax planning, bookkeeping, payroll), and regular updates. Encourage happy clients to leave reviews, they improve both trust and rankings. - Target Local Keywords

Incorporate location-based terms into your website. For example:

- “Accountants in [Your City]”

- “Small business tax accountant [Location]”

- “Bookkeeping services near me”

Create dedicated landing pages for your key locations to rank more effectively.

- “Accountants in [Your City]”

- Get Local Citations & Backlinks

Being listed in trusted directories and local websites boosts your credibility. Consider joining your local Chamber of Commerce, sponsoring community events, or contributing expert articles to local publications. - Mobile-First Website Design

A large percentage of local searches happen on mobile. Ensure your website loads fast, looks professional, and has a clear call-to-action (like “Book a Free Consultation”).

By investing in local SEO, accounting firms can ensure that when potential clients in their area search for services, their firm is one of the first results they see.

Strategy 2: Online Listings & Directories for Accountants

One of the most overlooked aspects of marketing for accounting firms is getting listed on the right online directories. Many accountants assume directories don’t bring results, but in reality, they are highly trusted by clients who want independent, unbiased ways to find professional services.

Why Listings Matter

- Third-party credibility: Being listed on trusted platforms like VouchedFor or Unbiased adds legitimacy.

- Lead generation: These sites are often the first stop for people actively looking for accountants.

- SEO boost: Directory profiles often rank on Google themselves, helping you appear in more searches.

Must-Have Listings for Accountants

- VouchedFor – One of the most popular UK platforms for accountants, financial advisers, and tax professionals. It works like a “Trustpilot for finance.”

- Unbiased – A go-to website for people searching for accountants and advisers, generating thousands of monthly leads.

- Yell & Yelp – While generic, these directories still drive local traffic.

- Industry Bodies – If you’re ACCA or ICAEW accredited, ensure your profile is updated on their websites.

- Review Sites – Trustpilot and Google Reviews are essential for social proof.

How to Optimise Directory Profiles

- Use professional headshots and team photos.

- Highlight your specialisms (e.g., “Contractor tax returns” or “CIS rebates”).

- Keep your contact details consistent with your website.

- Collect reviews directly on these platforms — many prospects will read reviews before contacting you.

Being proactive with directory listings isn’t just about visibility. It’s about making it easy for potential clients to trust you before they even reach your website.

Strategy 3 : Social Media Marketing with Video Content, Real-World Inspiration + Tactics

Social media is a powerful channel for marketing for accounting firms, and video content is where the engagement is. But generic videos don’t cut it — to stand out, you should draw inspiration from creators who are already nailing it in the accounting/finance niche. Below are lessons you can adapt, plus content ideas drawn from real accounts.

What These Creators Do Well (and what you can borrow)

| Creator | What They Do Well | What You Can Emulate |

| Abigail Rose Foster | Combines education and personality, uses props, storytelling. E.g. she’s known for breaking down tax topics into digestible reels and sometimes making a “blunder” mid-video to humanise her content. Facebook+2Facebook+2 | Use a prop mishap or “real moment” to make your video more human. Start with something surprising (“I made a mistake 27 seconds in…”) and then teach. |

| Josh Thomas (joshthomas.accountant) | His content often includes provocative hooks: “Tired of HMRC being your largest shareholder?” Instagram or “Build wealth for your family by utilising a trust.” Instagram | Use strong, curiosity-driven hooks (“Are you letting HMRC own half your business?”). Then deliver value. |

| Mitchthetaxman | Posts short, direct messages about tax advice, challenging assumptions (“Stop relying on your accountant for tax advice”), Instagram | Use short, punchy clips calling out common mistakes clients make. Keep tone informal and direct. |

| Heath Hill Green | (While less data is publicly available, they’re active in niche accounting and finance communities, often blending motivational or personal branding with accounting insights.) | Use behind-the-scenes content, or share your own journey, challenges, or stories of mistakes and lessons. |

Content Ideas You Can Use (Inspired by Them)

- “Oops, I messed up – here’s what I learned” — show a real or staged error (like forgetting a step in tax calculation) and use it as a lesson.

- Provocative question hooks — e.g. “Are you paying too much tax because of this hidden rule?” or “Your accountant may be missing this!”

- Quick “tax tip in 30 seconds” — a micro-content video explaining a single tip (e.g. allowable expenses, capital allowances, tax deadlines).

- Before / After case stories — show the difference (in numbers) you helped a client achieve.

- Behind-the-scenes / day in the life — show your work setup, how your team processes work, or a snapshot of your day.

- Trend-based accountancy content — jump on trending sounds or challenges (on TikTok or Reels) but give them an accounting twist.

Best Practices for Execution

- Hook in the first 3 seconds — your opening line must intrigue (inspired by Josh Thomas-style hooks).

- Use subtitles — many consumers watch on mute.

- Keep it short & sweet — 30–60 seconds is ideal on Reels / TikTok / Shorts.

- Consistent branding — same colours, fonts, intro/outro, etc.

- Clear call to action (CTA) — e.g. “DM me for a tax review,” or “Click the link to book a free consult.”

- Repurpose smartly — one video can become a shorter reel, an audio clip, or a snippet for LinkedIn.

How This Fits into “Marketing for Accountants”

By weaving personality, stories, and direct value (informed by creators like Abigail, Josh, Mitch), you differentiate your firm from the “boring accountant” stereotype. When prospects see content that’s helpful and human, they’re more likely to reach out. Video builds trust faster than text alone.

Strategy 4: Paid Media & Google Search Ads

When it comes to marketing for accountants, paid advertising is one of the most effective ways to generate new leads. But not all paid campaigns are the same. Broadly speaking, ads can be divided into outbound marketing (you push your message to potential clients) and inbound marketing (you capture people already searching for your services).

Understanding the difference — and knowing when to use each — is crucial for accounting firms that want to attract high-quality clients without wasting budget.

Outbound Paid Ads (Facebook, Instagram, LinkedIn)

Outbound advertising means you’re reaching out to people who might not be actively searching for an accountant yet. Instead, you target them based on demographics, interests, or job titles.

Pros:

- Lower cost per click (CPC) compared to Google Ads.

- Great for building awareness among small business owners, freelancers, or start-ups.

- Ideal for promoting free resources (like tax guides, checklists, or webinars).

Cons:

- Leads are “colder” — prospects may not be ready to hire.

- Conversion rates can be lower unless your offer is very compelling.

Best Use: Outbound ads work best when combined with lead magnets and retargeting campaigns (e.g., targeting people who already visited your website).

Inbound Paid Ads (Google Search Ads)

Google Search Ads are different because they capture active intent. If someone searches “accountants in Birmingham” or “help with self-assessment tax return,” they’re already looking to buy. This makes Google Ads one of the strongest marketing tools for accountants.

Pros:

- High-quality leads — prospects are actively searching for accounting services.

- Excellent for local marketing (target specific postcodes or cities).

- Immediate visibility at the top of Google results.

Cons:

- Higher cost per click than Facebook or LinkedIn.

- Very competitive keywords (e.g., “accountant near me”) can be expensive.

- Requires ongoing optimisation to keep ROI strong.

Best Use: Google Ads are perfect for capturing clients who are ready to act. They work best when combined with optimised landing pages and clear CTAs (like “Book a Free Consultation Today”).

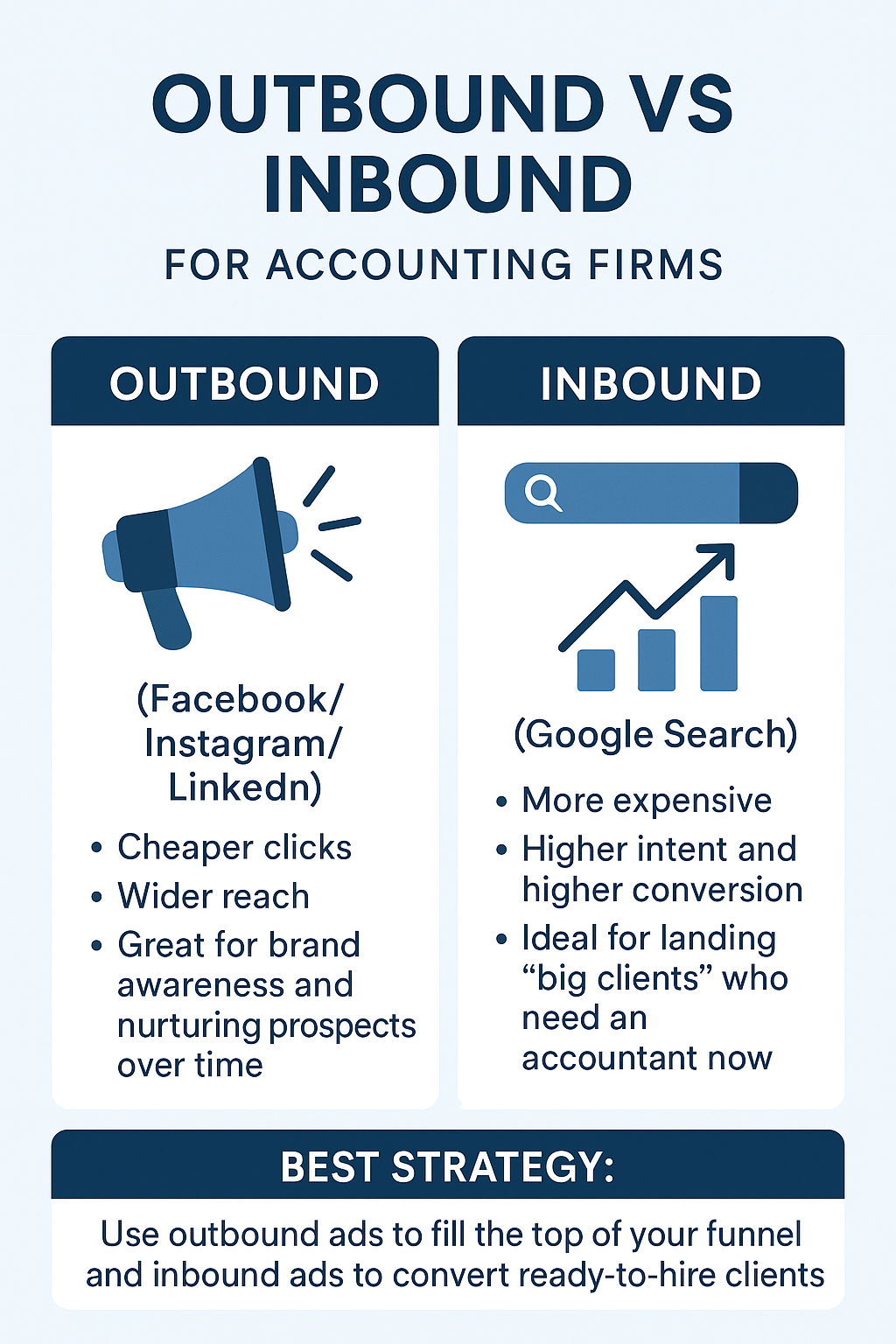

Outbound vs Inbound for Accounting Firms

- Outbound (Facebook/Instagram/LinkedIn): Cheaper clicks, wider reach, great for brand awareness and nurturing prospects over time.

- Inbound (Google Search): More expensive, but higher intent and higher conversion — ideal for landing “big clients” who need an accountant now.

- Best Strategy: Use outbound ads to fill the top of your funnel and inbound ads to convert ready-to-hire clients.

Brief Examples

- A London accounting firm combined Facebook lead ads with Google Search campaigns. Outbound ads generated leads at £8 each, while inbound Google leads cost £25 each but converted at a much higher rate (20%). The blended strategy gave them a steady pipeline.

- A sole practitioner in Manchester ran only Google Ads targeting “contractor accountants Manchester.” Although CPC was high (£5–£8), the campaign landed them 3 new long-term clients worth over £20k annually.

- A mid-sized practice used LinkedIn ads (outbound) to target CFOs and decision-makers in startups. These leads were nurtured with free guides until they were ready to book consultations.

Strategy 5: Content Marketing & Blogging for Accountants

If paid ads are like turning on a tap for instant leads, then content marketing is the long-term engine that builds your reputation, trust, and search visibility. For accountants, content marketing isn’t just about posting generic tax tips — it’s about creating valuable, client-focused content that positions your firm as an expert.

Why Content Marketing Works for Accounting Firms

- Builds trust: Clients want accountants who know their stuff. Well-written blogs, guides, and case studies prove your expertise.

- Improves SEO: Every new blog post is another opportunity to rank on Google for accounting-related keywords.

- Nurtures leads: A potential client may not hire you immediately, but they’ll remember the firm that consistently helps them understand complex tax rules.

Types of Content That Work Best for Accountants

- Educational Blogs

Write detailed posts answering common client questions, such as:

- “How to Fill in a Self Assessment Tax Return”

- “Tax Deadlines UK: What Small Businesses Need to Know”

- “Bookkeeping for Freelancers: A Step-by-Step Guide”

Optimise these for SEO so your firm ranks when people search these queries.

- “How to Fill in a Self Assessment Tax Return”

- Guides and Lead Magnets

Create free downloadable resources like:

- A Tax Deadlines Checklist

- A Step-by-Step Tax Return Guide

- A VAT Reclaim Calculator

Offer these in exchange for email addresses to build a pipeline of leads.

- A Tax Deadlines Checklist

- Case Studies & Success Stories

Share real client stories (with permission). For example:

- “How We Helped a Local Contractor Save £12,000 on Tax”

- “Scaling a Startup: Accounting Strategies That Worked”

These not only provide proof but also help potential clients picture themselves working with you.

- “How We Helped a Local Contractor Save £12,000 on Tax”

- Video Content as Blogs

Repurpose your short video clips into blog posts. For example, if you made a 60-second video explaining allowable expenses, expand it into a blog post with examples and tips. - News & Industry Insights

Cover changes in HMRC rules, Budget updates, or new tax reliefs. Timely blogs show you’re up to date and proactive.

How to Optimise Your Content for SEO

- Keyword research: Target long-tail terms like “accountants for landlords UK” or “best accountant for startups London.”

- Internal linking: Link your blogs to service pages (e.g., tax services, bookkeeping, payroll) to improve rankings.

- Local focus: Include location-based keywords in some posts (e.g., “Top 5 Tax Tips for Small Businesses in Birmingham”).

- Consistent posting: Aim for at least 2–3 blogs per month to keep building authority.

Brief Examples

- An accounting firm in Leeds published a weekly blog on tax return tips and saw a 40% increase in organic traffic in six months.

- A London-based practice created a free “Tax Planning for Contractors” PDF guide promoted on LinkedIn, generating 150+ email subscribers in one quarter.

- A Midlands accountant used case studies like “How We Helped a Startup Raise £100k in R&D Tax Credits,” which directly led to three inbound client enquiries.

Strategy 6: Building Trust Through Reviews & Case Studies

Accounting is a trust-based profession. When clients hand over their financial information, they want to know they’re working with someone reliable, knowledgeable, and approachable. This is why reviews and case studies are some of the most powerful tools in marketing for accountants.

Why Reviews Matter for Accountants

- Social proof drives decisions: According to BrightLocal, 87% of consumers read online reviews before engaging with a local business, and 79% trust online reviews as much as personal recommendations.

- Conversion impact: Businesses with more than 20 recent reviews convert almost 25% more clients compared to those with fewer or outdated reviews.

- SEO benefits: Google Reviews are a known local SEO ranking factor — meaning more reviews can literally move your firm higher in the “map pack.”

- Trust at first glance: Studies show that a business needs at least 4 out of 5 stars to be considered trustworthy by the majority of prospects.

Encouraging satisfied clients to leave positive reviews on Google, Trustpilot, or platforms like VouchedFor and Unbiased can be the deciding factor that tips a prospect toward choosing your firm.

How to Collect More Reviews

- Ask at the right time: After you’ve delivered a tax return or solved a complex issue, ask the client to leave feedback.

- Make it easy: Send direct links to your Google review page via email or WhatsApp.

- Incentivise ethically: Instead of discounts, offer added value like a free “tax health check.”

- Respond to all reviews: Thank clients for positives, and handle negatives politely — 89% of consumers say they are more likely to use a business that responds to reviews (BrightLocal).

The Power of Case Studies

Case studies go beyond short testimonials — they tell a story. They explain a client’s problem, how you approached it, and the results achieved. These stories work because they are relatable and results-driven.

Example framework for case studies:

- The challenge: What issue was the client facing? (e.g., “A contractor struggling with CIS deductions.”)

- The solution: What did your firm do? (e.g., “Streamlined bookkeeping and reclaimed £5,000 in overpaid tax.”)

- The outcome: What was the measurable result? (e.g., “Reduced tax liability and improved cash flow within 3 months.”)

Publishing these on your website, blog, and LinkedIn not only shows expertise but also helps prospects picture how you could help them too.

Strategy 7: Bringing It All Together with an Integrated Marketing Approach

Each of the strategies we’ve covered — from local SEO and directory listings to video content, paid ads, content marketing, and reviews — works well on its own. But the real power comes when accountants combine them into an integrated marketing strategy.

Why Integration Matters

- Consistency builds trust: Prospects should see the same message and professionalism whether they find you on Google, Instagram, or LinkedIn.

- Multiple touchpoints: Research shows it takes an average of 7 interactions before a prospect converts into a client. By being present across search, social, and directories, you create those touchpoints.

- Balanced results: SEO and content marketing build long-term growth, while paid ads deliver immediate leads. Reviews and case studies strengthen trust at every stage of the funnel.

How to Create an Integrated Marketing Plan for Accountants

- Start with SEO foundations – Optimise your website for local keywords and claim your Google Business Profile.

- Layer on social media – Create short, engaging videos to humanise your brand and share expertise.

- Run paid campaigns strategically – Use outbound ads for awareness and inbound Google Ads for high-intent leads.

- Build authority with content – Publish blogs, guides, and case studies that show you understand your clients’ challenges.

- Close with social proof – Use reviews, testimonials, and success stories to reassure prospects at the decision stage.

Turn Marketing into Bigger Clients

Marketing for accountants isn’t about throwing money at ads or posting random content. It’s about building a system that attracts the right clients, proves your expertise, and nurtures trust until they’re ready to hire.

By combining local SEO, online listings, social media video content, paid ads, Google search campaigns, content marketing, and reviews, you’ll create a marketing engine that consistently delivers bigger and better clients.

The accounting firms that win in today’s market aren’t necessarily the biggest — they’re the ones that are visible, approachable, and trusted.

If you want to land more high-value clients and stop relying only on word of mouth, now is the time to put these strategies into action.

👉 Next step: Start small. Optimise your Google Business Profile, ask three happy clients for reviews this week, or post your first short video on LinkedIn. Marketing doesn’t have to be overwhelming — but it does have to be consistent.

I’ve been working in the field of marketing for accountants for over five years, helping firms across the UK attract better clients, strengthen their online presence, and scale sustainably. If you have any questions about the strategies in this guide — or if you’d like tailored advice for your firm — feel free to reach out.

👉 Let’s start a conversation and see how the right marketing approach can take your accounting practice to the next level.